Every industry today is jumping on the generative AI gravy train to efficiency and success.

Zion Market Research predicts that the AI market, primarily helped by generative artificial intelligence, will grow by 39.4% to USD 422 billion by 2028.

So, it would be unwise for financial institutions like insurance companies to miss out on everything this relatively new technology offers as it helps them leverage and understand customer behavior.

But it’s essential to take a step back from the hype to consider whether generative is suitable for your insurance company, what you can do to adopt it successfully, and how to make this happen.

To help you revolutionize your enterprise with generative AI for insurance, this article will cover the following topics:

- Why are enterprises adopting generative AI for insurance?

- What are the benefits of generative AI for insurance?

- What 6 challenges exist in generative AI for insurance?

- How can you implement generative AI for insurance? Functions and use cases

- Is generative AI safe?

Why are enterprises adopting generative AI for insurance?

Insurance providers increasingly recognize the importance of utilizing Generative AI, a highly advanced area of insurance technology.

By providing valuable information, Generative AI can greatly assist insurance companies in better understanding and serving their clients to provide an outstanding customer experience.

Creating products or services customized according to customer preferences, as gathered from customer information, will enhance customer satisfaction and optimize adoption and retention.

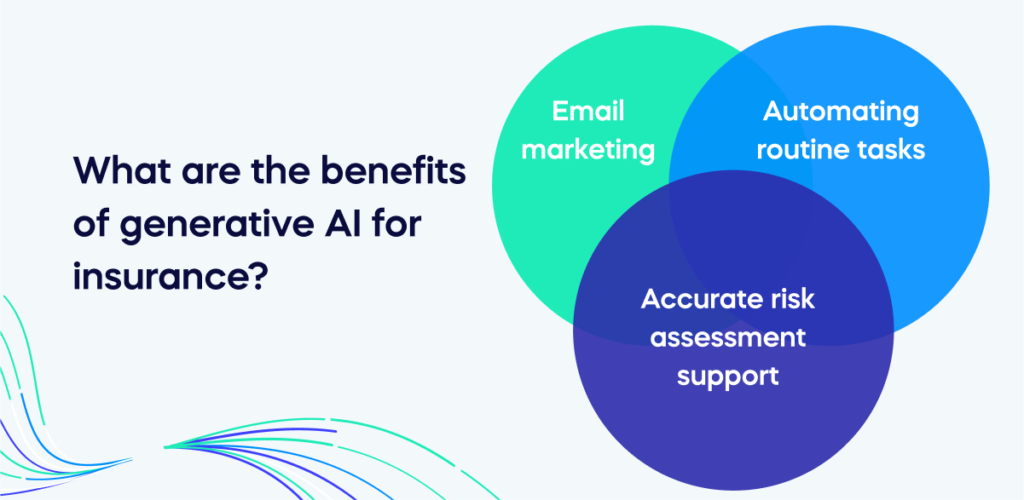

What are the benefits of generative AI for insurance?

There are many benefits of different generative AI architectures for insurance, the first being that they can automate routine tasks.

Automating routine tasks

With generative AI, you can enhance your insurance marketing strategy by automating tasks like creating and sending personalized email blasts and text messages and more efficient data analysis.

Furthermore, you can leverage generative AI to develop targeted advertisements customized to each client by providing your chosen AI tool with customer information such as a customer’s claims history, demographic details, and preferences.

Email marketing

Generative AI tools can be helpful in email marketing by creating customized and engaging email content, evaluating customer information, and suggesting ideal groups for specific email campaigns.

You can also use your tool to produce impactful subject lines and descriptions for product promotion emails, thus enhancing the efficiency of email marketing efforts through optimized product engagement.

These actions can assist insurance agents in saving valuable time while producing excellent outcomes.

Accurate risk assessment support

ChatGPT can assist insurance agents in catching up with providing accurate risk assessments and competitive premiums for their customers.

With a massive range of data points, ChatGPT offers more precise assessments, resulting in improved customer coverage at the right price.

Insurance agents can benefit from this accurate risk evaluation by efficiently handling customer claims and inquiries.

What 6 challenges exist in generative AI for insurance?

Like many disruptive technologies, just as generative AI offers solutions to some problems, it also presents its challenges. Considering these challenges before integrating this tool into your enterprise is essential to promote a successful generative AI transformation.

1. Technical complexity

The typical business may find it challenging to work with generative AI models due to their complexity, which can involve billions or even trillions of parameters.

At Gartner, Arun Chandrasekaran, vice president, analyst, and tech innovation, says, “These models are impractically large to train for most organizations.”

According to Arun, the technology can become expensive and environmentally harmful due to the required computing resources. As a result, businesses will most likely adopt generative AI through cloud APIs with limited customization soon.

It is helpful to use a DAP (digital adoption platform) to tackle technical complexity in a way your staff understands. A DAP utilizes in-app guidance and personalized training to allow the team to train as they use new digital tools, reducing waste and maintaining changes for the future.

2. Legacy systems

Enterprises may face added challenges when introducing generative AI into their legacy technology setups. IT leaders must decide whether to incorporate the new system with the old one or replace it altogether.

This point is due to the difference in how legacy systems and productive AI approach tasks, meaning that organizations must adopt new technologies or create integrations to achieve the same results more efficiently.

3. Technical debt

If businesses don’t succeed in making significant changes by implementing Generative AI, it could become another technical debt alongside legacy systems.

Bill Bragg, the CIO at SymphonyAI, a provider of AI SaaS for enterprises, suggests that if a company wants to justify its investment in AI for customer support, merely reducing workload by having human agents handle fewer cases is not enough.

The company would need to reduce the number of agents in front-line support roles significantly

4. AI hallucinations and misuse

The use of AI models for content creation reduces costs for businesses. However, it also makes it easier for threat actors to create convincing deep fakes by altering existing content. These manipulated videos, images, or audio are highly personalized and closely resemble the original.

5. Algorithmic biases

The development of new technology may result in intellectual property problems, which could lead to legal consequences for businesses.

“Generative AI models have the added risk of seeking training data at a massive scale, without considering the creator’s approval, which could lead to copyright issues,” Chandrasekaran said.

6. Maintaining oversight and coordination

Organizations frequently establish centers of excellence (CoE) to concentrate on the effective adoption and rollout of new technologies.

These centers can be beneficial in the application of generative AI. Not having a team devoted to understanding and utilizing this capability may result in becoming obsolete.

As a result, centers of excellence should be present in every industry and organization.

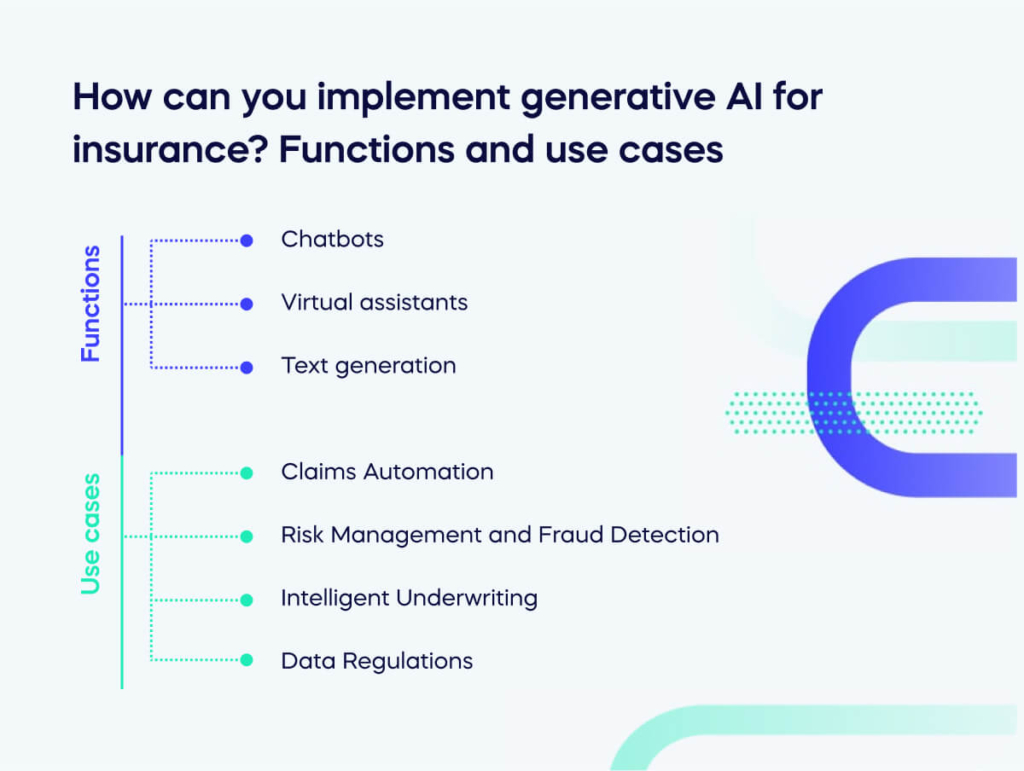

How can you implement generative AI for insurance? Functions and use cases

It is helpful to consider ways to implement generative AI before investment.

Look at the short video below to get your creative juices flowing for ideas on implementing generative AI before moving on to the functions and use cases.

Functions

There are various functions you can use to implement generative AI for insurance.

Chatbots

You can utilize generative AI tools to deeply an AI chatbot to meet customer needs, answer their inquiries, assist them with information, and execute operations in a conversational and natural approach using ChatBot.

Virtual assistants

With ChatGPT, you can develop a virtual assistant to support users in completing tasks, offer suggestions, and carry out other operations.

Text generation

Tools like ChatGPT can produce text content such as product descriptions, headlines, and summaries. This content is generated based on specific prompts or inputs the user gives and can give more detailed answers than previous AI tools could ever offer.

Use cases

Looking at use cases for generative AI for insurance can help you decide the best way to implement it into your insurance value chain.

Claims Automation

By studying historical claims and identifying new ones that fit previous patterns, Generative AI will automate the workflow for processing insurance claims.

When a claim fits within a set of criteria, the system can process it automatically, significantly reducing the working time on claims administrators and speeding up claims processing.

Risk Management and Fraud Detection

Generative AI will assist in identifying cases by analyzing claim data and identifying patterns and anomalies that may detect fraud risk or abuse, such as lengthy workers’ reimbursement with no advancement, excessive use of medical resources, or inconsistent injury complaints.

Intelligent Underwriting

In insurance, Generative AI can assist underwriters by identifying critical documents and extracting essential data, freeing them on higher-value tasks.

AI could automate the management structure process for data calls, reducing underwriting professionals’ workload and allowing for more efficient time management.

Data Regulations

Generative AI technologies will work efficiently when there is a large volume of data from various sources.

As a result, carriers must create a streamlined and actionable strategy for internal and external data. You must also organize internal data to facilitate and support the rapid development of real-time insights and functionality.

Is generative AI safe?

Despite all the advantages generative AI can offer your insurance company, there are safety factors to consider.

Accuracy

While generative AI tools train on extensive data, they are still machine-learning models and may generate errors or provide inaccurate information.

It’s crucial to double-check and confirm the accuracy of any details provided by your generative AI tool before utilizing it.

Data Privacy

Users must be mindful of the data they collect and share using generative AI tools, despite AI companies implementing cyber security measures to protect customer data, as risks remain around data privacy and security.

Bias

When using generative tools like ChatGPT, it’s crucial to remember that it was trained using internet data and may contain biases that reflect the preferences in the training data.

Therefore, it’s essential to consider multiple sources of information and take caution when relying on ChatGPT or other generative AI tools to make critical decisions.

ChatGPT can be beneficial when utilized appropriately and considering its limitations and possible risks.

Use a DAP to support your generative AI for insurance adoption

Incorporating a Digital Adoption Platform (DAP) into your generative AI for insurance adoption strategy is a crucial step toward success and digital resilience.

The integration of generative AI in the insurance industry holds immense potential, but it also requires a systematic approach to ensure smooth implementation and user adoption.

A DAP is a powerful tool for guiding employees through learning, providing step-by-step instructions, interactive tutorials, and real-time support.

By leveraging a DAP, insurance companies can accelerate the adoption of generative AI technology, reduce training time, minimize resistance to change, and maximize ROI to maintain a successful insurance business.