The oil and gas industry is not known for being at the cutting edge of technology. In fact, according to Deloitte, O&G ranks last in digital maturity compared to all other industries.

This same study concluded that the O&G industry loses $1.6 trillion in potential revenue due to “failing to fully embrace digital.”

Credit: oilandgas.com

Last year, a partner at Energy Ventures, Shantanu Agarwal, said: “Small oil and gas companies are still running off of Excel. They have to move to the cloud. They have to get to those new business systems. These guys need adoption.”

This industry is behind in the digital race, and it’s time to catch up. For the O&G companies that have experimented with more technology, the results have been incredible. Digital transformation has finally hit the industry and it’s taking off.

According to an Ernst & Young survey, 70% of O&G companies plan on deploying (Internet of Things) IoT this year and next. And according to Technavio, the global digital transformation market in O&G will grow by $34 billion by 2023.

Let’s take a look at the O&G process and how this industry can utilize technology for increased success.

The O&G Supply Chain

There are 3 main stages in the production of oil and gas:

Upstream

Upstream oil and gas production is conducted by companies that detect, extract, and produce raw materials. These processes are the first step in the supply chain.

Midstream

Midstream companies manage the bridge between extraction (upstream) and distribution (downstream). This includes storage, transportation, and pipelines and gathering systems.

Downstream

Downstream is the post-production process of raw material once they’ve been extracted. This is the stage that turns oil and gas into products that we, the consumers, buy directly. This step in the supply chain includes oil refineries, and of course, petroleum, diesel, and gasoline distributors.

Upstream capabilities have taken off

The oil and gas process begins with exploring and surveying the terrain for ideal drilling locations. In order to assess potential drilling sites, companies traditionally would manually gather information about the environment and make basic, short-term decisions based on that information.

Exploration involves identifying deposits and drill wells. Bringing more smart technology into this process is proving to be extremely productive and lucrative. According to a Microsoft and Accenture report, 89% of oil and gas executives believe that they can leverage analytics to improve their business practices.

Now, using sensors that are able to measure factors such as temperature, pressure, and anomalies, significantly less man-power is necessary to assess environments, and the amount of data that can be gathered and analyzed is exponential. In fact, managing the massive amount of data from upstream production is posing one of the biggest challenges for industry companies. Data storage and transmission is a major hurdle.

A huge digital success for one company took place in 2016, when gasoline mogul, Royal Dutch Shell, made an $87,000 investment in cutting edge digital technology to monitor their oilfields in the temperamental and often dangerous Nigerian terrain. They chose to use Random Phase Multiple Access technology, developed by engineers who formerly worked for Qualcomm, to replace their manual data collection. The solution needed to be able to cover tough terrain and have long-range transmission capabilities.

After only one year of deploying the equipment and utilizing software, Shell realized a $1 million return on their investment. This was due to the reduction in necessary site visits and the expedited data gathering and transmission process.

According to Business Insider, the estimated number of devices used on oil extraction sites will increase by 70% in the coming year. The top technology for this stage in the industry is predicted to be an internet-connected sensor device used to provide metrics about the environment of extraction sites. Just like the Shell success story, oil and gas exploration and production will benefit greatly from integrating more digital capabilities into their processes.

Midstream and downstream companies are finding their digital footing

The equipment and maintenance used for transporting and refining raw materials are in dire need of an upgrade.

According to a Deloitte University Press report, over 2,200 unscheduled refinery shutdowns occurred in the U.S. between 2009 and 2013. Each shutdown cost the global process industry up to 5% of its total production. This translates into roughly $20 billion lost on shutdowns alone. On top of that, maintenance practices that are ineffective also result in shutdowns and cost refiners an additional $60 billion per year in operating costs.

Getting the process management to go digital for this industry is almost too obvious. Several companies, including DCP Midstream, OSIsoft, and BP dramatically lowered their maintenance and operational costs with digital capabilities that allowed them to find and fix pump cavitation problems.

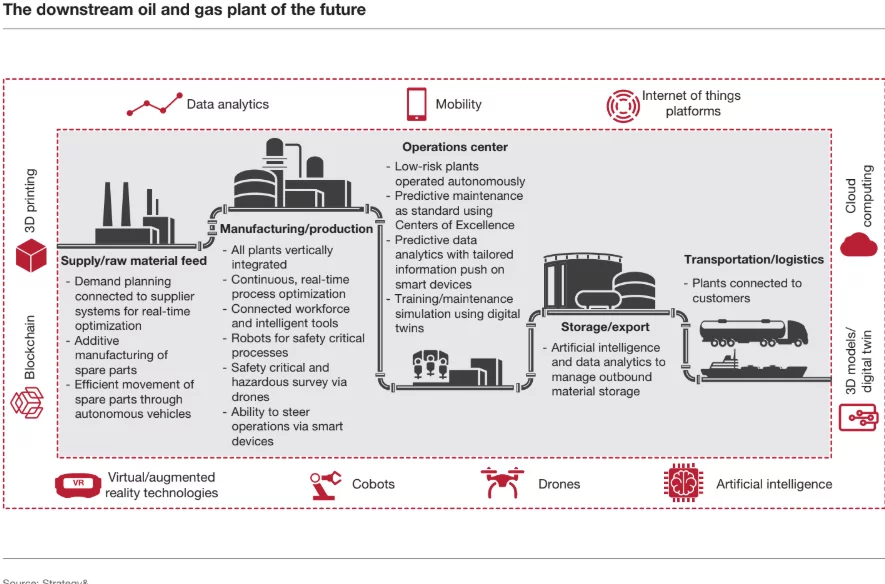

The clear next step on the path for O&G digital transformation is getting all refineries and downstream facilities to be maintained and monitored by technology.

Credit: AMEinfo.com

An AMEinfo report estimated that by incorporating digital capabilities, downstream oil and gas operations could cut costs by 20% and could increase efficiency by 12%.

“Digitization is more than an opportunity,” states the report, “It is an imperative.”

Leaks in the fuel pipeline and theft from illegal pipe taps are another huge drain for the industry costing about $10 billion in the US. There are already technologies that can prevent leaks and taps with sensors and cloud data.

The market is beyond ripe for insight capabilities and further development of data implementation. Transportation, storage, and distribution will continue to realize exponential benefits from continued digitalization.

Potential pitfalls for the industry’s digital journey

Whenever an industry is new to technology and software, there is a serious learning curve that companies need to weather. Change management will inevitably be a real and potentially costly challenge for the massive workforce that drives these oil and gas companies.

Executives in the industry will need to develop new business strategies that are digitally enabled and that take the full potential of their data into account.

Upstream employees, including geologists, rig operators, engineers, and drilling contractors and workers, will all be shifting their role descriptions and expectations as more and more technology enters their space. The potential benefits are extremely lucrative, but the ROI will depend greatly on the executive decisions regarding organizational ability to adapt to and adopt their new capabilities.

On the midstream and downstream end of production, companies need to prepare for a new type of workforce: a younger and more digitally oriented one.

According to a survey done by a recruitment firm based in the UK, O&G companies are concerned that there won’t be enough new professionals to replace those that are soon retiring. Millennials don’t see the industry as appealing.

In order to attract the next generation of employees, an updated and more digitally-savvy industry image is in order. This makeover will be costly, but if done carefully and strategically, it will most definitely be worthwhile.

Going digital also means going green

Yet another compelling reason to embrace technology in this industry, is that methane emissions are a huge factor in the ever-increasing climate control issues.

With the advanced technologies and data capabilities discussed above, oil and gas companies will be much more efficient at preventing, detecting, and fixing methane leaks. By automating these processes, methane emissions will decrease dramatically.

For an industry that has such a bad rep, quickly finding and adopting environmental solutions should be at the top of its priority list. For companies struggling now to regain the face of their consumers – going digital is a realistic and efficient way to go green as well.

Microsoft and other tech companies are starting initiatives to specifically target and solve oil and gas issues. An estimated 80% of upstream and 90% of downstream executives in the industry will already be experimenting with new digital capabilities in 2020.

Climate change is only getting worse, and this industry’s companies have everything to gain by aligning themselves with the solution rather than with the problem. With incredible potential to leverage AI, quantum computing, sensors, cloud storage, and many more capabilities, it seems that the digital race for O&G has begun.