Few things create more immediate stress for employees than payroll errors. When someone’s paycheck is wrong, it doesn’t just mean paperwork, it can mean scrambling to cover rent, explaining overdraft fees, or watching bills go unpaid. While the complexity of tax codes and compliance requirements will always make payroll challenging, the processes themselves can be streamlined to protect both employees’ financial stability and organizational compliance.

The problem is that many organizations still rely on fragmented systems and manual processes that create exactly the errors they’re trying to avoid. When payroll accuracy averages just 80% across organizations and each mistake costs about $291 to fix, the impact extends far beyond administrative inconvenience.

What is payroll maintenance?

Payroll maintenance is the ongoing process of calculating wages, managing deductions, processing tax withholdings, and handling off-cycle payments accurately and on time. It typically includes:

- Calculating regular wages and overtime according to labor laws

- Managing tax withholdings and compliance across multiple jurisdictions

- Processing deductions for benefits, garnishments, and voluntary contributions

- Handling off-cycle payments, corrections, and adjustments

While this sounds routine, effective payroll maintenance requires precise coordination between HR systems, tax regulations, and employee data. When these elements aren’t properly integrated, organizations face compliance risks, financial penalties, and damaged employee trust.

The challenges

For most teams, the biggest hurdle is the fragmented nature of payroll processes. Different teams may handle various aspects of payroll using different systems, creating inconsistencies in tax rules, payment calculations, and compliance procedures. This decentralized approach makes it nearly impossible to maintain accuracy and consistency.

Traditional payroll workflows compound the problem. Manual data entry and spreadsheet-based calculations slow down processing and increase error rates, while compliance requirements across multiple jurisdictions create complexity that’s difficult to manage without proper systems. The pressure to process payroll on tight deadlines often means mistakes get discovered only after paychecks are issued.

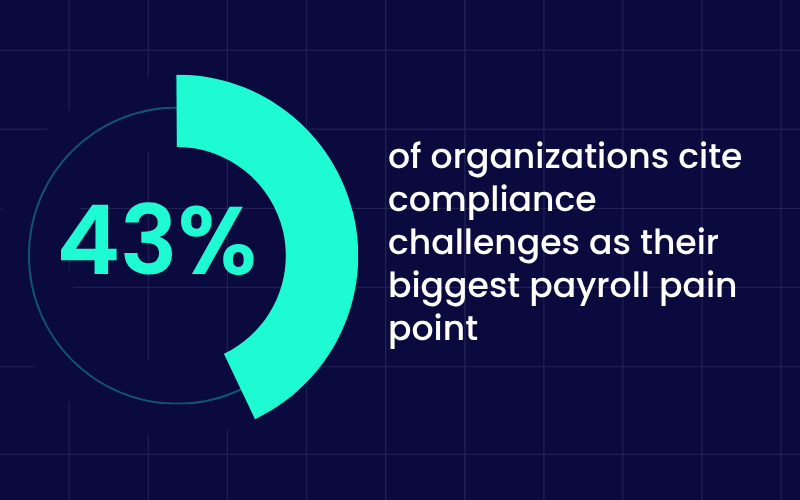

It’s no surprise that 43% of organizations cite compliance challenges as their biggest payroll pain point, especially in multi-jurisdiction environments. Without proper guidance and automated safeguards, even experienced payroll teams struggle to maintain the accuracy that employees depend on.

The Solution: WalkMe

This is where digital adoption platforms like WalkMe become game-changers.

Rather than relying on manual processes and hoping for accuracy, these platforms provide real-time guidance directly within payroll systems. WalkMe, specifically, offers step-by-step workflows, automated validation checks, and compliance reminders that help payroll teams catch errors before they impact employees’ paychecks.

The results speak for themselves: organizations using guided payroll processes see significant improvements in accuracy and compliance while reducing the time spent on error correction and rework. But implementation success depends on following proven best practices.

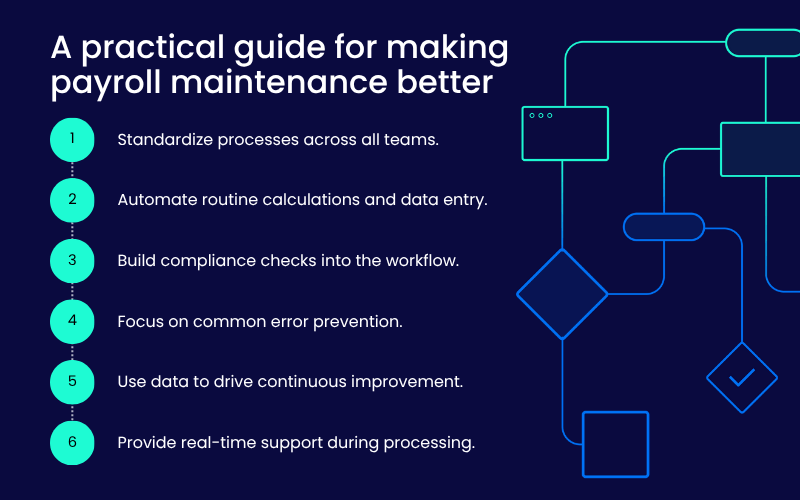

A practical guide for making payroll maintenance better

- Standardize processes across all teams

Consistent payroll procedures prevent misclassifications and ensure accurate withholdings regardless of who processes the payroll. Tools like WalkMe can guide teams through standardized workflows, ensuring tax rules and payment calculations remain consistent across different locations and processors.

- Automate routine calculations and data entry

Automation eliminates the manual data entry that leads to most payroll errors. Automated systems can handle hours calculations, leave accruals, and standard deductions while digital guidance ensures proper setup and ongoing accuracy of these automated processes.

- Build compliance checks into the workflow

Rather than treating compliance as an afterthought, embed regulatory requirements directly into payroll processing. WalkMe can provide real-time reminders about tax deadlines, wage and hour requirements, and jurisdiction-specific rules at the moment they’re needed.

- Focus on common error prevention

Target the most frequent sources of payroll mistakes—employee misclassification, incorrect overtime calculations, and inaccurate tax withholdings. Digital guidance can provide validation checks and prompts that prevent these issues before they reach employees’ paychecks.

- Use data to drive continuous improvement

Track payroll accuracy rates, processing times, and error patterns to identify improvement opportunities. Analytics from guided payroll systems help teams understand where mistakes happen most frequently and refine processes accordingly.

- Provide real-time support during processing

In-app guidance eliminates the need to hunt for policy manuals or tax tables during payroll processing. WalkMe can deliver relevant information, calculations, and compliance checks directly within the payroll system, reducing errors and speeding up processing.

Putting it all together

The combination of these strategies creates a comprehensive payroll ecosystem. When implemented effectively with platforms like WalkMe, payroll teams can process accurately and efficiently while maintaining compliance across complex regulatory environments.

Although U.S. workers lose more than $92 billion annually in retirement savings due to early account cashouts often triggered by payroll-related financial stress, many organizations still underinvest in payroll accuracy and guidance systems. WalkMe bridges this gap by ensuring payroll processes are guided, consistent, and designed to protect both organizational compliance and employee financial stability.

What success looks like

When payroll maintenance is done well, the benefits are clear:

- Higher accuracy rates and fewer costly corrections

- Stronger compliance with tax regulations and labor laws

- Reduced processing time and administrative overhead

- Greater employee trust and financial security

Organizations that invest in improving payroll maintenance create ripple effects that extend far beyond the HR department. When employees can trust their paychecks to be accurate and on time, they can focus on their work rather than financial stress. This reliability becomes a foundation for employee satisfaction and long-term financial planning, contributing to both retention and overall workplace stability.